Irs payroll deduction calculator

The Payroll Deduction IRA is probably the simplest retirement arrangement that a business can have. Some states follow the federal tax.

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

IRS tax forms.

. You can enter your current payroll. Our Average ERC Client Receives over 1M. No plan document needs to be adopted under this arrangement.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Our Average ERC Client Receives over 1M. IRS is offering coronavirus relief to taxpayers and many businesses will qualify for two tax credits - the Credit for Sick and Family Leave and the Employee.

We Document Eligibility Calculate ERC Submit. All Services Backed by Tax Guarantee. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

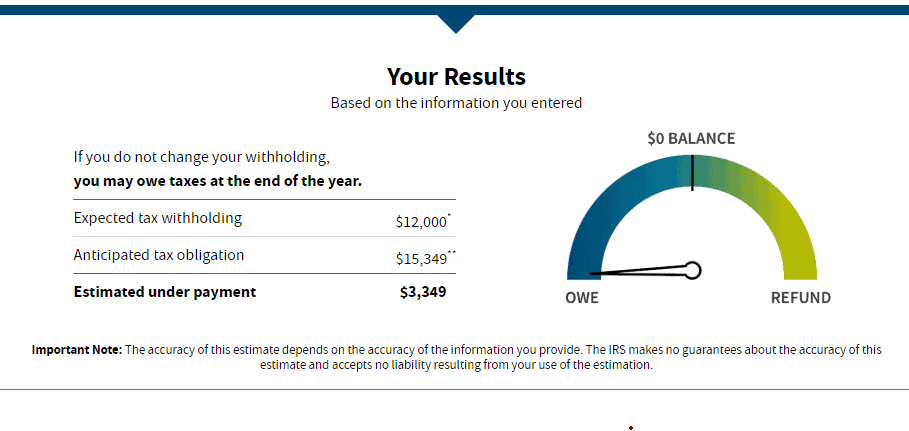

For help with your withholding you may use the Tax Withholding Estimator. The maximum an employee will pay in 2022 is 911400. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

New job or other paid work. Calculate and deduct federal income tax using the employees W-4 form and IRS tax tables for that calendar year. This publication supplements Pub.

Total Non-Tax Deductions. When to Check Your Withholding. Payroll Deductions Calculator Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Thats where our paycheck calculator comes in. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. 51 Agricultural Employers Tax Guide.

Save a copy of the spreadsheet with the employees name in the file name. You can use the Tax Withholding. 15 Employers Tax Guide and Pub.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult. Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Discover Helpful Information And Resources On Taxes From AARP. The calculator includes options for estimating Federal Social Security and Medicare Tax.

When you have a major life change. The state tax year is also 12 months but it differs from state to state. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Check your tax withholding every year especially. Ad Payroll So Easy You Can Set It Up Run It Yourself. Each pay period open each employees Tax Withholding Assistant spreadsheet and enter the wage.

Withhold 765 of adjusted gross pay for Medicare and Social. What does eSmart Paychecks FREE Payroll Calculator do. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. It describes how to figure withholding using the Wage.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use this simplified payroll deductions calculator to help you determine your net paycheck. The information you give your employer on Form W4.

We Document Eligibility Calculate ERC Submit. Get tax withholding right. For example if an employee earns 1500 per week the individuals annual.

IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes.

Stubhub Pricing Calculator Irs Taxes Pricing Calculator Irs

What Is A Payroll Tax Payroll Taxes Tax Attorney Payroll

Pin On Kreig Llc

Irs Witholding Calculator

How To Do Your Own Taxes Tax Time Tax Return Tax Season

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Form 656 Ppv Offer In Compromise Periodic Payment Voucher Offer In Compromise Tax Debt Debt Problem

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Tax Withholding Estimator Shortcomings Virginia Cpa

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Calculation Of Federal Employment Taxes Payroll Services

Pin On Starting A Business Side Hustles After Divorce

Fp62pm2ar1cjfm

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Platinum Tax Defenders Tax Debt Irs Taxes Payroll Taxes

2